Is the GTA Condo Market Bottoming? A Buyer’s Opportunity Guide

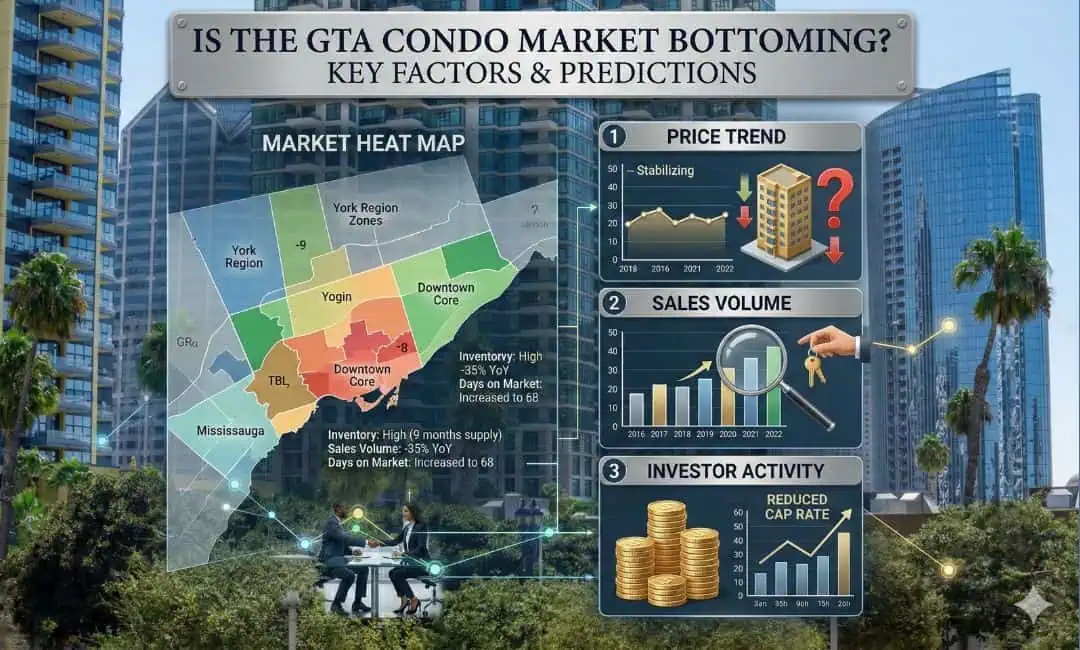

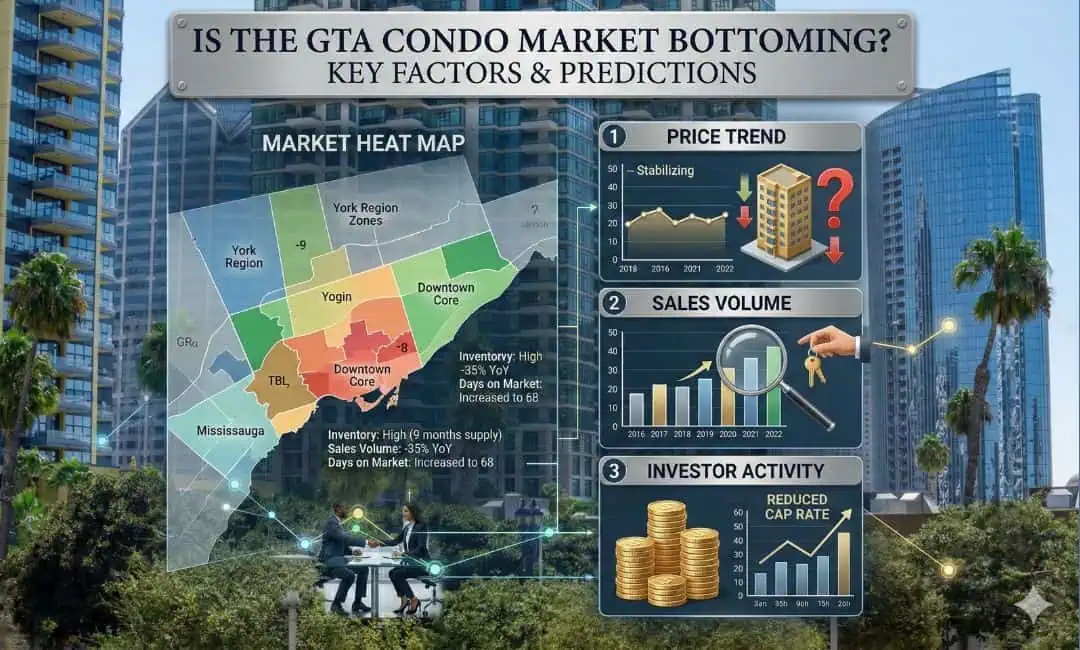

Have you been watching the GTA condo market forecast closely and wondering if now is the right time to buy? Many Canadians, especially students, first-time buyers,

Have you been watching the GTA condo market forecast closely and wondering if now is the right time to buy? Many Canadians, especially students, first-time buyers,

Buying a home in Ontario finally feels less rushed. And that change matters more than many buyers realize. For years, the market pushed buyers to move

Mortgage rules in Ontario are changing quickly, and many buyers feel overwhelmed. Owning a high-value home in Ontario has always been challenging. But for buyers looking

A new downtown is emerging in the GTA, offering an alternative to Toronto that’s impossible to ignore. I want to talk about Vaughan Metropolitan Centre real

Thinking of selling your home this fall? And they skip homes that don’t feel “right” in seconds. That’s why many sellers ask me one big question:

I remember the first time I wanted to invest in property. I checked prices in Toronto and Vancouver, and honestly, it felt impossible. Down payments were

Imagine making a property deal where everything happens automatically without needing lawyers, agents, or tons of paperwork. That’s exactly what smart contracts in real estate aim

Imagine buying or selling property without endless paperwork. Yes, blockchain in real estate is making that dream a reality. It is changing how people buy, sell,

If you are like most Canadian homeowners, you feel the pressure from all sides.Energy bills keep climbing. Winters feel longer. Summers feel hotter. And every time

Canada has always been a land of opportunity for property buyers. Real estate is a major market here. People get excited about owning their piece of

When people think of Hamilton today, they imagine more than just the “Steel City.” Choosing the best area in Hamilton can feel confusing. The city has

If you are looking for areas to avoid in Barrie, then this guide is for you. I know — deciding where to live or visit can

Are you searching for the best areas in Cambridge to live, invest, or raise your family? I know moving to a new city can make you

When people ask me about the areas to avoid in Cambridge, I always start with one simple truth — Cambridge, Ontario, is still one of the

The question on everyone’s mind is simple: Is a Canadian real estate market crash coming? I hear it every single day from buyers, sellers, investors, and

Time management for realtors is something many agents put off until they’re feeling stressed. But it’s actually one of the most important skills you can have.

Did you know: In Canada, the average home price in some cities has jumped more than 50% in just five years? That’s a massive jump—and it’s

Are you thinking about buying a home or investing in Milton? Milton’s real estate market is booming, and everyone seems to be talking about it. I

Are you searching for the best areas to live in Markham, Ontario? You want a welcoming community, safe streets, great schools, and a place that feels

Thinking about moving to Brampton? It’s a great city, but it’s important to know about areas to avoid in Brampton. Some neighborhoods have higher crime rates

Thinking about moving to Milton, Ontario? You’re not alone. This small town in the GTA is growing fast—and for good reason. Families, young professionals, and even

Brampton has been getting a lot of attention. It’s growing quickly and becoming a great place to live. So, have you ever wondered where the richest

Many people are choosing to move to Brampton, and it’s easy to see why. Some of the best neighborhoods in Brampton offer great homes, good schools,

Thinking about moving to Toronto but not sure where to live? When I first explored the best areas to live in Toronto, I was shocked by

When you’re planning to move to a new place, safety should be your main concern. There are some dangerous neighbourhoods in Toronto with higher crime rates,

The idea of real estate investment in Toronto can feel scary, right? Prices are high. The market moves fast. You might be thinking, “How do I

Let’s be honest—trying to make sense of Toronto real estate trends can feel overwhelming. You hear about skyrocketing prices, bidding wars, and confusing stats. But what

The Brampton housing market is one of the busiest in Ontario. Whether you are buying your first home, moving to a bigger one, or looking to

Looking for the Best Mississauga Neighborhoods to Live in? With so many great areas to choose from, it can be hard to decide where to start.

Each city in Canada has neighborhoods that make people stop and stare. We all know Toronto leads this list when it comes to wealth and luxury

The Canadian housing affordability crisis is more severe than ever. With property prices rising sharply, many Canadians are finding it harder to buy a home. The

The Canadian real estate market has faced some challenges over the past few years. But not all cities are struggling. Real estate recovery in Calgary and

The Canadian home sales decline of nearly 10% in February 2025 signals a slowdown in the real estate market. While the national outlook may seem uncertain,

The real estate market in Toronto is changing. Understanding how supply and demand affect the market is key to predicting future home prices. Toronto is a

Navigating fluctuating home prices in Canada can be overwhelming for potential buyers. The real estate market is constantly changing, with prices going up and down depending

In 2025, recent interest rate cuts are shaping the Canadian housing market outlook. The Bank of Canada has lowered interest rates, and many Canadians are asking

If you’ve been watching Toronto’s housing market, you’ve probably noticed some exciting trends. In 2025, the Toronto new listings 2025 and Toronto home sales growth will

If you’re watching Toronto’s housing market, you’re curious about what’s happening in 2025. The Toronto housing market 2025 shows some exciting changes that could impact how

In 2025, the Bank of Canada decided to lower its interest rates. This change affects many Canadians, especially when borrowing money, mortgages, and overall finances. Interest

A key decision for home buyers in Canada is whether to buy a new or pre-owned home. Both have their benefits and challenges. Should you buy

Building a home is an exciting journey but can also be challenging. Construction delays, plan changes, and builder mistakes are common issues for many. If you’re

As Ontario’s 2025 Provincial Election approaches, housing policies are one of the most significant issues. Housing costs have been high for years, and many people struggle

So, you’ve finally decided to take the plunge into homeownership – congratulations! You’ve crunched the numbers, figured out your down payment, and maybe even started browsing

Picture this: You’re scrolling through property listings and suddenly realize the real estate landscape has completely transformed. Gone are the days of traditional home buying and

Want to make your home more innovative and more valuable in 2025? Smart home upgrades are a great way to do it. Investing in smart home

If you’re thinking about buying or investing in commercial real estate in Canada, you may need a commercial real estate loan. Investing in commercial real estate

Pre-construction sales are an exciting part of the Canadian real estate market. As a real estate expert, understanding how pre-construction works can open up a world

Pre-construction real estate is a great opportunity for both investors and homebuyers. It allows buyers to purchase a property before it is built. For real estate

Vancouver is known for its stunning scenery, vibrant city life, and high-end properties. The Vancouver luxury real estate market is always evolving, influenced by economic trends,

The luxury real estate market is booming. Vancouver’s global real estate trends are playing a huge role in shaping its future. Have you ever wondered how

Are you torn between buying or renting a luxury home in Vancouver? With its stunning views, top-notch amenities, and vibrant lifestyle, Vancouver luxury real estate is

Canada’s luxury real estate market is doing well, despite rising interest rates. This is surprising because many buyers are feeling the impact of higher borrowing costs.

Real Estate Investment Trusts (REITs) are growing fast. One reason for this growth is the rising demand for multi-family properties. More and more investors are turning

The issue of Canadian housing affordability has been a big concern for many years. More and more Canadians are finding it hard to afford a home.

When we talk about Toronto home affordability income requirements, the numbers are shocking. The dream of owning a home here is slipping away for many. I

I don’t need to tell you that the Vancouver housing crisis is real. If you live here, you feel it every single day. Prices are sky-high,

The Canadian real estate market has experienced stagnant home prices. This comes despite strong demand in major cities like Toronto, Vancouver, and Montreal. As we progress

Canada’s housing market is feeling the pressure as high interest rates continue. Home prices across the country remain stagnant, despite high demand in major cities. Many

Immigration is at the heart of Canada’s growth story. Every year, thousands of people move here in search of a better future. But with this growth

In today’s competitive real estate market, digital marketing is a game changer for agents looking to stand out. Digital marketing for real estate agents in Canada

Let’s be honest — buying a home in Canada is already stressful. You’re trying to manage property showings, read through all the legal documents, and somehow

A real estate transaction is one of the most significant financial events in a person’s life. It’s exciting but can also feel overwhelming. From legal documents

Thinking about making a move in Canada’s property market? If you’re buying, selling, or starting in real estate, you need to understand real estate laws—it’s more

If you’re working in real estate—or planning to join the industry in Canada—understanding commission and brokerage fees is essential. As a realtor, your earnings largely depend

Wondering what a real estate brokerage is and how it helps in Canada’s real estate market? Well, understanding brokerages is key when you are planning to

Want to offer more value to your clients? Discount brokerage firms in Canada can help. These firms make it easy with low-cost, flexible services. They give

In Canada’s real estate market, standing out has become more challenging than ever. With growing competition and a digitally connected audience, real estate agents need to

As a real estate agent in Canada, choosing the right brokerage is a big decision that can have a huge impact on your career. Your brokerage

If you’re a real estate agent or thinking about becoming one in Canada, you’ve likely heard the term brokerage fee. But what exactly does it mean,

If you’re thinking of buying or selling a property in Brampton, Ontario, having a professional real estate agent on your side can make all the difference.

In today’s market, making good money as a real estate agent takes more than just listing houses. With prices changing and new trends emerging, it can

Curious about how much real estate agents make? You’re not alone. Many people wonder what it’s like to work in this exciting field and, more importantly,

If you’re looking for a new home in Brampton, Ontario, you might be feeling a mix of excitement and a little stress. Well, finding the perfect

Buying your first home is an exciting adventure! However, it can also be overwhelming. There are many steps to consider, and you might feel lost at

In the real estate business, getting steady leads is key to success. One of the best ways to do this is by building a strong referral

In 2024, top real estate companies in Canada are expected to help the economy recover by boosting the commercial real estate market. This is happening because

Choosing the top real estate agent can seem tough, but it doesn’t have to be! Whether you’re buying or selling a home, the agent you choose

In today’s busy world, technology is changing how we buy and sell homes. Real estate agents are using new tools to make the process faster and

Selling your home in Toronto can be a big decision. With the right strategy, you can not only sell quickly but also maximize your profits. Toronto’s

Success in real estate involves more than simply buying and selling properties. It’s about building relationships and being part of a community. Connecting and being active

Did you know that many deals fall apart because of weak closing strategies?Effective real estate sales closing techniques are often the key difference between a successful

Finding the right property can feel like an emotional rollercoaster. There are many ups and downs, from visiting homes to negotiating prices and signing contracts. It

A Real Estate CRM (Customer Relationship Management) is a powerful tool that helps real estate agents manage their clients and listings more effectively. Think of it

Client relationship marketing focuses on building strong connections in real estate. But, many real estate agents face challenges. It includes competition, short client attention spans, and

In 2025, the real estate landscape continues to evolve. Now buyers have more details than ever at their fingertips. However, despite online tools, buyers still depend

Buying or selling a home in Canada can be expensive. However, if you work with the right real estate brokerage, you can save a lot of

In this digital world, buyers and sellers are changing how they buy and sell homes. One of the most exciting new tools in real estate is

High interest rates are shaking up the real estate market in Canada. When borrowing costs go up, it becomes more expensive for investors to finance properties.

The Canadian real estate market is going through a period of adjustment. In 2024, buyers, sellers, and investors face new challenges. The market is shifting, and

As a real estate agent, you often juggle marketing, scheduling, and touring homes. It can feel like a lot to handle on your own. But with

If you’re looking at the Saskatchewan real estate market in 2025, you’re in the right place. Knowing what’s happening in the market is essential whether you’re

Vancouver is tackling its housing crisis with a new plan. The city designed the ten-year housing plan to provide affordable and accessible housing. This initiative is

When you start your real estate career, the brokerage or team you join can make a big difference. Finding a place to grow, learn, and feel

The relationship between household net worth and real estate market trends is essential for understanding the economy. In the first quarter of 2024, the wealth of

Canada is facing growing concerns about household debt. This issue has significant implications for financial stability. Recent data shows that the household debt service ratio (DSR)

As per the latest report, the Bank of Canada (BoC) is planning another interest rate cut. Despite the weak Canadian dollar, they believe further rate cuts

Are you ready to embark on the exciting journey of buying or selling a property in Vaughan City? Whether you are a seasoned investor or a

Finding the finest real estate agent in Vaughan can significantly impact your home buying or selling experience. The right agent can offer valuable insights, negotiate effectively,

Toronto, one of Canada’s largest and most vibrant cities, is known for its diversity, cultural richness, and economic opportunities. However, it also faces significant challenges, particularly

The dream of owning a home is something many Canadians share, especially first-time home buyers. To help make this dream a reality, the Canadian government, through

Are you considering the impact of artificial intelligence on real estate? In recent years, technology has revolutionized every sector of the economy, and real estate is

Real estate is a dynamic industry in Canada, with real estate agents playing a crucial role in buying, selling, and renting properties. But how much do

In the competitive world of real estate, branding, and marketing are indispensable tools that help realtors stand out and attract more clients. With the advent of

In the competitive world of real estate, buyer agents play a pivotal role in guiding clients through one of the most significant transactions of their lives.

Oakville, a beautiful town nestled in the Greater Toronto Area, offers ample opportunities for new real estate agents. With its stunning landscapes, upscale neighborhoods, and vibrant

Are you looking for the best neighbourhoods in Vaughan, but where should you start? Picking a neighbourhood is a big decision. You’re probably asking: Are the

Are you a real estate agent considering your next move? Oakville offers a dynamic environment for both buyers and sellers. Well, choosing the right city to work

Are you considering becoming a real estate broker in Vaughan? It’s essential to understand the pros and cons of working with a real estate brokerage company

Finding the perfect home in Mississauga is a thrilling endeavor, and the key to a successful journey lies in selecting the right real estate agent. Making

Wondering what a real estate agent does? Well, they do a lot more than just show you houses. They help you clarify your needs and preferences,

A lot of homebuyers in Canada might not realize exactly who’s on their side when it comes to a real estate deal. It’s easy to assume

In the real estate landscape, finding the right real estate brokerage in Canada can significantly impact your success. It can also shape your professional reputation and

Book a Confidential Meeting with our Broker of Record